Treasury Liquidity Poses a Threat to Entire Financial System I know that’s not a very popular answer, but I think that’s the most intellectually honest one,” Gayed said.

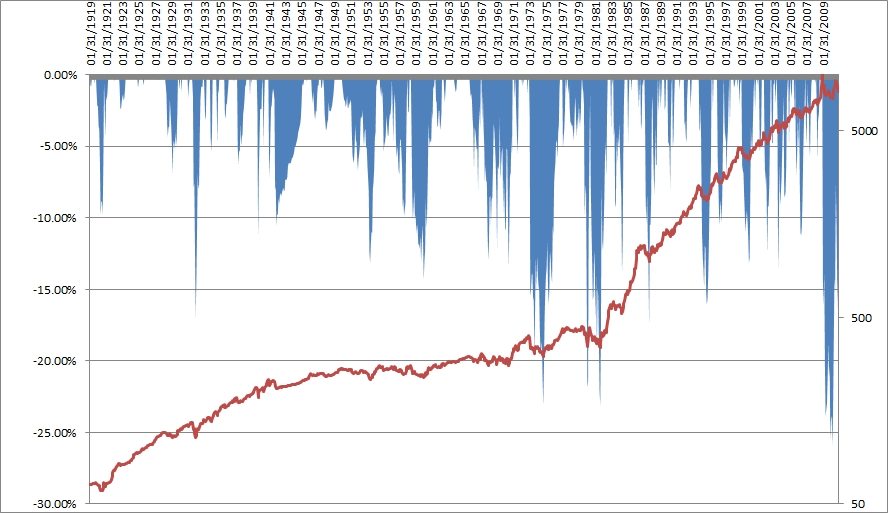

BOND DRAWDOWN FULL

You will always have anomalies and dislocations, where you can’t exactly put together all the causation, because you may not necessarily have full causation around any, one or two variables. “You can argue that that’s where the bubble was, but I think part of this is also just these things happen in data sets. Rate hikes only accelerated their inevitable drop. Gayed’s case is relatively straightforward: Treasury prices were already bloated heading into the year. Part of it is inflationary, but I think the harsh reality is … you can argue it was overvalued.” I have an issue with that narrative, because the drawdown for Treasuries started August 2020, way before the Fed started hiking rates … Now, part of it, I don’t disagree, is because of the Fed hiking rates fast, and everybody else. “… Most people are going to say is because of the Fed. As such, short-term Treasuries especially tend to be extremely sensitive to changes in lending environments, of which a 4% increase in the benchmark rate would more than qualify.Īccording to Gayed, rate hikes offer a partial but imperfect answer to this year’s would-be bond market crash. Bond yields are essentially interest on government loans. Via increasingly hefty rate hikes throughout the year, the central bank has pushed the federal funds rate from near-zero at the start of the year to its current 4% level. The obvious answer is, predictably, the Federal Reserve. The question remains: Why are bonds so unstable? The fact that prices and yields are fluctuating so drastically this year is a bad omen for the state of U.S.

debt, the safest lender in the world, and offer a fixed return on principle after a set amount of years. Treasuries, basically by definition, should be more stable than the variable-return equity markets. As such, a breakdown in Treasuries has long-reaching consequences across the entire U.S. Treasury yields are the benchmark by which the entire financial world is based, including everything from mortgage rates to the cost of government debt. What’s been eating away at the fixed-income sector and what does it mean for the markets going forward?įed Rate Hikes Have Put Undue Pressure on Treasuries This year is the only year in history where Treasuries are down more than equities in a steep equity drawdown.”īonds are the steady backbone of both domestic and international financial systems. In nine out of those top 20 drawdowns, Treasuries lost you money, but they lost you a lot less going back to 1961. You could’ve actually made money being in Treasuries during those stock market declines. “If you were to look at the top 20 biggest declines, the biggest drawdowns for the S&P going back to 1961 … In 10 out of those top 20 largest drawdowns for stocks, Treasuries … made money, meaning they were the counter asset. For most of the year, long-term bonds have suffered steeper losses than most stock indices.Īccording to Gayed, this is a historically unprecedented sign: This phenomenon typically pushes bond prices up and yields down when stocks sink. As equity markets tumble, it’s only natural for investors to seek safe haven in the quiet, steady, consistent world of corporate or government bonds.

Bonds and stocks typically move in opposite directions. While the S&P licks its wounds after shedding more than 15% of its weight through the course of the year, long-duration Treasuries are still down more than 24%, an undeniably strange phenomenon. Gayed, Chartered Financial Analyst, mutual fund manager, publisher of the Lead-Lag Report and staple of financial Twitter, the story of this year’s economy is rooted in bonds - and it still hasn’t reached its final chapter. For as much as the S&P 500’s decline this year has tended to dominate headlines, it may come as a surprise that a bond market crash is the more devastating - and realistic - possibility.

0 kommentar(er)

0 kommentar(er)